According to The New York Times (Sept. 21, p. 8), Henry Paulson, the Secretary of the Treasury,

owned stock in Goldman Sacks amounting $809 million in January 2008. Because of the stock market

decline, the value of this stock still owned by Mr. Paulson was "only" $523 million on Friday September

19th, by the time Paulson and Bernanke were proposing the biggest bailout in history. The poor

guy, Paulson (we don’t know about Ben Bernanke, is he allowed to own stocks?) had lost almost 300

million in nine months, about 2 million per day! But he was not alone. According to the same source

Maurice Greenberg, the former CEO of AIG had lost 1200 million, and James Cayne, former CEO of

Bear Stearns had lost 999 millions in the same nine months. Millionaires who own stocks in banks are

watching how their riches disappear as the value of stocks approaches to zero.

In a typical way of acting that does not allow any time for calm consideration, Henry Paulson and

Ben Bernanke proposed a bailout plan which transfers taxpayer money to financial institutions that

are almost bankrupt. At first it was said that the amount of the bailout would be close to one trillion

dollars, which means one million millions. In recent days the figure has been reduced to “only” 700

billion, which means 700,000 million (these numbers are so big that they need to be explained). The

crux of the reasoning, we are told, is that if the bailout doesn’t proceed, the financial system will collapse

and that will enormously hurt “taxpayers”, i.e., the American people.

I am not going to deny that the situation of the financial system is bad, it is. Not only in the United

States but worldwide financial institutions are going through very turbulent times. Bad debts seem to

be hidden everywhere. So perhaps today we are at the beginning of a situation that may well be similar

to what was called the Great Depression, the period in the 1930s in which the market economies of the

world were in shambles. However, what I do deny is that the plan Bernanke, Paulson, and the leaders

of both parties are proposing is a prudent and wise use of money. I deny that this plan is convenient

for the citizens, and that it is the interest of “we,” the taxpayers, to make a gift to the superrich to avoid

worse evils.

When a week ago Henry Paulson and Ben Bernanke apparently became the new kings of the United

States—Dick and George seem to have abdicated—, financial markets had already been in a meltdown

for a few months. In March Bear Stearns, one of the biggest investment banks in the world, was

bought by JPMorgan with the generous support of taxpayer money. This was the first big gift to the

rich. Then Fannie Mae, Freddie Mac, Lehman Brothers and AIG came down, and since no buyers were

in sight, taxpayer money bought the stocks. This was indeed buying trash and giving handouts to the

rich, because the price paid for these stocks was much higher than any offer in the market.

The transfers of taxpayer money to the rich implied by the subsidized sale of Bear Stearns and the

nationalization (with overgenerous compensation) of AIG and the mortgage corporations Freddy and

Fannie were generous handouts to bankers and “investors.” However, the hemorrhage was profuse

and the blood did not stop flowing. Furthermore, something terrible was occurring, we were getting

closer and closer to... communism! Big financial institutions were falling in the hands of the government

and this could have continued who knows to what extent! Maybe we were following the path of

communist Sweden, where nationalizations of failing enterprises in recent decades have enlarged the

government-owned sector of the economy to about three fourths of GDP. (As we all know, Swedish

citizens are now being sent to the Gulag—if you have not heard yet, it will soon be in Fox News, Sarah

Pallin may already know about it.)

So the new kings Henry and Ben decided to put their feet on the brake and save us from taking the

road to communist serfdom. Money must be given directly to the rich. Hands off! No public ownership

of banks or enterprises is intended! Bankers and all financial speculators, please just give us (the public)

all your trashy assets, and we will give you good taxpayers money. The jargon used to reflect this

(and deceive people) is as follows: “the government will accept illiquid assets so that confidence and

liquidity will be restored to financial markets.”

This is probably a pivotal time in history. Whether we are at the start of a new great depression or

whether the plot of the rich succeeds in keeping things running to their liking (which looks unlikely),

“we,” taxpayers and citizens and workers are going to suffer. Whatever happens the next few weeks in

Congress, it is likely that unemployment will go up, as has been true over recent years during which a

real hemorrhage of jobs has occurred in all industrial economies. Jobs are moving to countries like

China, India, or Vietnam, were workers often work for twelve or more hours a day six or seven days a

week, and the running wage is often less than a dollar an hour.

Of course, though not as bad as starving, or being thrown out of your home, or being hurt or killed,

being unemployed is a bad thing. But in recent years unemployment rates in European countries have

been at levels well over 10% and major social crises have not occurred. Modern societies are rich

enough to provide income support for the unemployed. In Spain joblessness was around or well above

20% during most of the 1990s and in the early 1990s in Finland unemployment suddenly rose from 3%

to 18% when the major buyer of Finnish products, the USSR, collapsed. Interestingly, mayor indicators

of social welfare like longevity continued improving in these countries during these years.

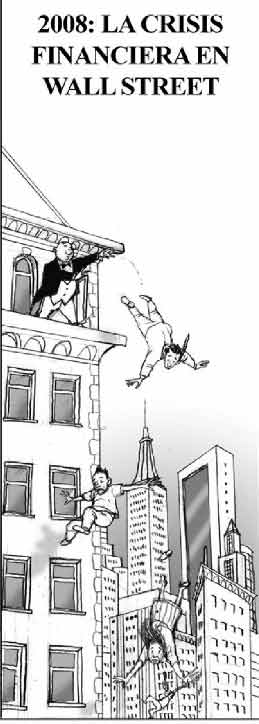

Financiers throwing themselves out of the windows of Wall Street are one of the myths of the Great

Depression mythology. However, it does appear to be true that suicides (mostly of poor people) go up

when the economy goes down. But the picture of the 1930s Great Depression as a great crisis in which

western societies were in free fall and self-destruction is a misleading one. For instance, infant mortality

continued falling during the 1930s in Western countries—except in very poor groups— and though

suicides increased, deaths due to heart disease, cirrhosis and many other major ailments continued

dropping, so that overall, the longevity of the population improved. This is in stark contrast with what

happened in Eastern Europe and the countries of the Soviet Union in the 1990s, when following the

advice of financial institutions like the World Bank and economists like Jeffrey Sacks a shock therapy

was applied, everything was privatized and social services were largely suppressed. This created a few

hundred of new millionaires—former communist officers in most cases—as well as a social disaster in

which millions lost their savings and pensions and fell into poverty. Suicides skyrocketed, but also

heart disease, homicides, tuberculosis and alcohol-related deaths went through the roof and even infant

deaths went up, creating a huge drop in longevity.

The establishment is now crying wolf to scare us and force on society sweeping transfers of wealth to

the rich, who are destroying themselves. If these enormous transfers of wealth are finally accomplished,

those who promoted irresponsible spending and borrowing and performed irresponsibly

themselves will benefit. They will save the day by using up taxpayer money, and will do their best to

continue enriching themselves. Though there is considerable uncertainty on whether the financial bailout

proposed by Wall Street, Paulson and Bernanke will be successful in avoiding a severe economic

downturn (economists are strongly divided on its possible effectiveness), what is clear is that the only

purpose of the plan is to reinstate “business as usual,” i.e., the economic environment of the last years

in which the real income of most people has been stagnant of declining, working hours have increased

under pressure of being fired or not competitive enough with your coworkers, social inequality has

strongly expanded, and the American ruling class has been exceedingly happy in embarking into wars

and destroying the real economy, and the environment in which we live.

The financial crisis or even an economic recession is not a nuclear war or a tornado. Economic depressions

neither destroy factories nor harvests, nor put people out of their homes. What destroys economic

resources and expels people from the places where they live are the property rights of the superrich.

They don’t care about throwing people into the street when rents or mortgages are not paid, they

don’t mind destroying harvests if they cannot be sold, and they don’t worry about leaving machines

and factories to rust if they cannot be used to produce for profit.

If the financial crisis deepens into depression and unemployment rises, the unemployed can be

given income support and retraining. Employment in failing enterprises can be substituted by new

jobs, and public money will be indispensable for all this. Thought I do believe with Albert Einstein that

a socialist organization of the economy is desirable and necessary for the humanity to be able to deal

effectively with its present problems, I am conscious that very few people share these views, and I of

course agree that a Russian style socialism is not wanted—even less a Chinese one, though American

leaders seem to be now on very good terms with Chinese communists nowadays. Freedom and real

democracy are basic ingredients of any decent society of the 21st century. In any case, over the next few

years and decades public money will be needed for more important things than financing Blackwaters

and Halliburtons in overseas wars, or paying billions for the worthless pieces of paper that the superrich

are now anxious to discard.

José A. Tapia

University of Michigan

jatapia at umich.edu

September 30, 2008